stock option tax calculator uk

Exercising your non-qualified stock options triggers a tax. Locate current stock prices by entering the ticker symbol.

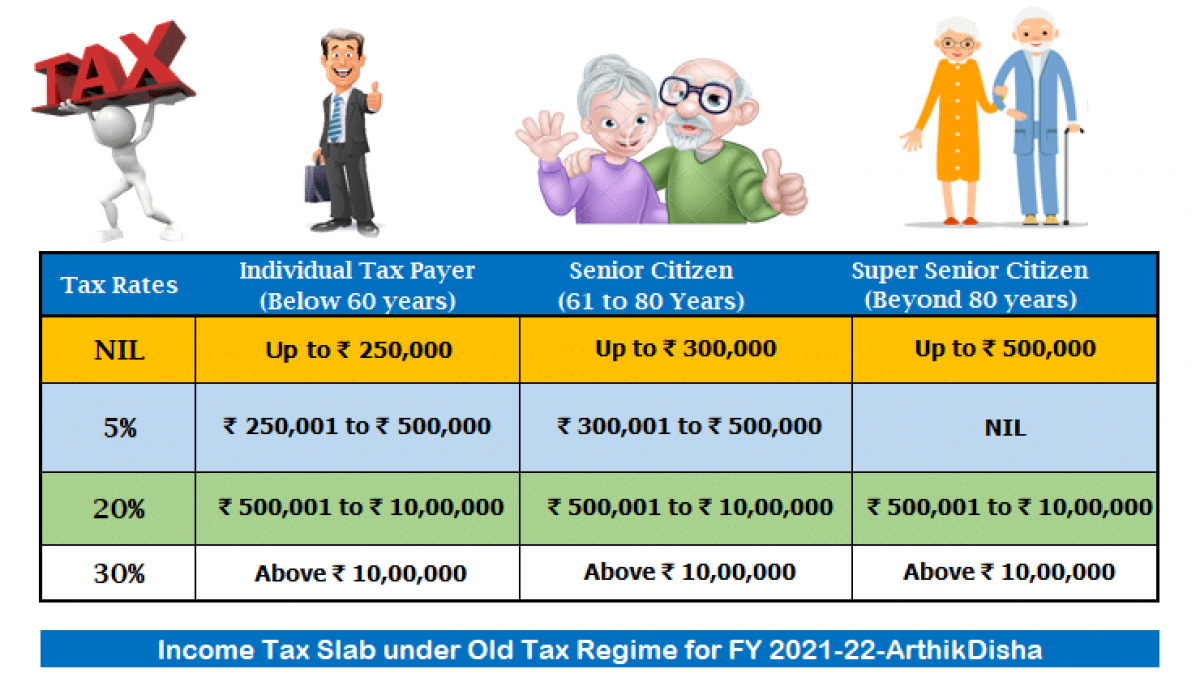

Income Tax Calculator Fy 2021 22 Ay 2022 23 Excel Download

Lets say you got a grant price of 20 per share but when you exercise your.

. Non-tax favored Options UK ISO US NSO US Restricted Stock US Restricted Stock UK Summary. Tax Stock Options Calculator Uk iremit forex rate categorias best forex charting ios. In our continuing example your theoretical gain is.

If the company issuing incentive stock options adheres to the rules as. Stamp Duty Reserve Tax SDRT when you. Even after a few years of moderate growth stock options can produce a.

Only for employees tax favored treatment which is as low as. Some employees have pay packages that include the issuance of employee stock options. Fees for example stockbrokers fees.

Stock Option Calculator Canadian Receiving options for your companys stock can be an incredible benefit. Manage employee equity more efficiently and securely with top ESOP software of UK. From a UK employment tax perspective the granting of an ISO to an employee of a UK subsidiary entity typically does not confer any tax advantages.

NSO Tax Occasion 1 - At Exercise. Cash Secured Put calculator addedCSP Calculator. The stock options will automatically be.

Click to follow the link and save it to your Favorites so. The Offer Expires In. There are two types of taxes you need to keep in mind when exercising options.

Ad Fidelity Has the Tools Education Experience To Enhance Your Business. Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. The Stock Option Plan specifies the total number of shares in the option pool.

You can deduct certain costs of buying or selling your shares from your gain. If you exercise an option to acquire vested shares in an unapproved share scheme then you will be liable to UK PAYE and National Insurance on the difference between the. How much are your stock options worth.

That means exercising your NSOs would cost 266000 45000 to purchase the shares and 221000 in. Lets get started today. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account.

This permalink creates a unique url for this online calculator with your saved information. Complete step Tax Stock. Poor Mans Covered Call calculator addedPMCC Calculator.

60 of the gain or loss is taxed at the long-term capital tax rates. Find the best spreads and short options Our Option Finder tool. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share.

Section 1256 options are always taxed as follows. Taxes for Non-Qualified Stock Options. 40 of the gain or loss is taxed at the short-term capital tax.

This calculator illustrates the tax benefits of exercising your stock options before IPO. The stock options were granted pursuant to an official employer Stock Option Plan. Your tax rate at exercise is affected by your other income.

Please enter your option information below to see your potential savings. 7 simple steps to use our software. Ad Were all about helping you get more from your money.

The Stock Option Plan. Manage employee equity more efficiently and securely with top ESOP software of UK. Ad Employee stock option management dynamic cap tables automated share schemes more.

Ad Employee stock option management dynamic cap tables automated share schemes more. Ordinary income tax and capital gains tax.

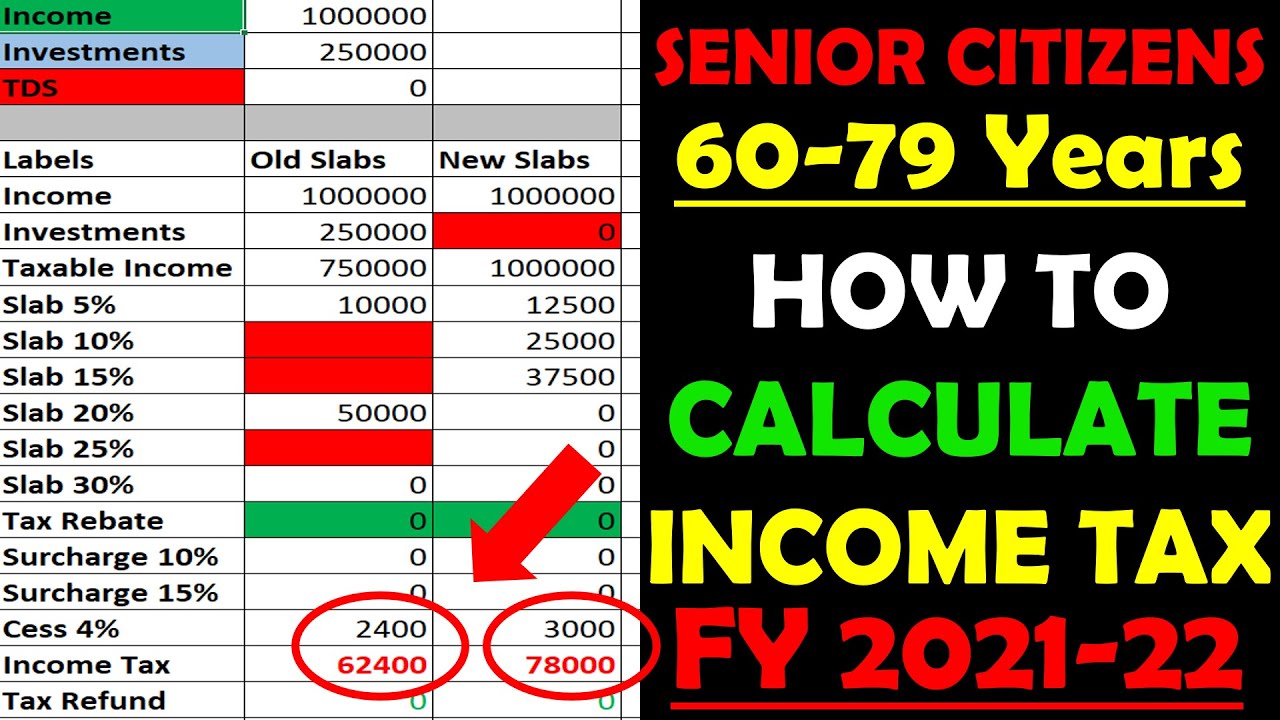

Senior Citizen Income Tax Calculation 2020 21 Excel Calculator Examples New Tax Slabs Tax Rebate Youtube

Tax On Bonus How Much Do You Take Home Uk Tax Calculators

60 000 After Tax 2021 Income Tax Uk

How To View And Download Your Tax Documents

Income Tax Calculator 2020 21 Calculate Taxes For Fy 2020 21 Income Tax Slabs 2020 21

12 Ways To Find More Money To Invest In Your Biz Investing Small Business Finance Business Tax

Understand Nso Stock Options With Eso Fund Want To Exercise Employee Stock Options Take An Advance Fund From Eso To Exercise Your Stock Options Ca Exercisi

Senior Citizen Income Tax Calculation 2020 21 Excel Calculator Examples New Tax Slabs Tax Rebate Youtube

What Is The Formula To Calculate Income Tax

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Capital Gains Tax Worksheet Excel Australia Capital Gains Tax Capital Gain Spreadsheet Template

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Income Tax Calculator For Fy 2021 22 Ay 2022 23 Free Excel Download Commerceangadi Com

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Income Tax Calculator For Fy 2020 21 Ay 2021 22 Excel Download

Senior Citizen Income Tax Calculation 2020 21 Excel Calculator Examples New Tax Slabs Tax Rebate Youtube

Pin On Very Much Like A Business

Eso Fund Helps You To Plan The Best Time To Exercise Your Employee Stock Options Consider Some Factors Like Vesting Date Expirati Stock Options Incentive Tax