st louis county personal property tax waiver

Reduce property taxes 4 residential retail businesses - profitable side business hustle. Talk To A Lawyer.

Charles County on January 1 of the required tax year.

. How do I get a St Louis County personal property tax waiver. You moved to Missouri from out-of-state. We recommend visiting of our office to obtain the waiver.

A paid personal property tax receipt from the Collector of Revenues office or A property tax waiver from the City Assessors office if no personal property tax was assessed for the prior year. Ad Avoid Costly Mistakes with Professional-looking Legible and Error-free Legal Forms. Louis you must obtain your property tax waiver from the county in which you lived on January 1st.

Talk To A Title Company. Check Your Local Assessors Office. You may pay at our office located at 729 Maple Street Hillsboro MO 63050 online at Jefferson County Property Taxes or by Interactive Voice Response by calling 877-690-3729 if paying by IVR you will need to know your bill number.

Knock On Their Door Or Leave A Note. You will need to contact the assessor in the county of your residence to request the statement or non-assessment and to be added to the assessment roll for the subsequent tax year. For a pamphlet with information on Small Claims Court call 314-615-2601 or 314-615-2592.

To declare your personal property declare online by April 1st or download the printable forms. For information call 314-615-8091. Daly Collector of Revenue 1200 Market Street Room 109 St.

A waiver or statement of non-assessment is obtained from the county or City of St. A waiver or statement of non-assessment is obtained from the county or City of St. Monday - Friday 8 AM - 5 PM.

Central Avenue in Clayton MO 63105. St louis county personal property tax waiver. Complete the online request form or visit the Assessors Office at 201 N.

If you do not receive a form by mid-February please contact Personal Property at. Go To Your Local Library. Use your account number and access code located on your assessment form and follow the prompts.

If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov. Louis County Missouri - St. Check The County Clerk.

A Certificate of Personal Property Non-Assessment may be obtained from the Assessors Office if you did not own a vehicle in St. Browse Legal Forms by Category Fill Out E-Sign Share It Online. Louis officials estimated that if property values remained the same and there were no mechanism to replace lost revenue personal property tax revenue to the city would drop from nearly 164 million in 2020 to 492 by 2026.

Louis County Circuit Court 7900 Carondelet in Clayton Monday through Friday 800 am to 500 pm. Make an appointment to visit us at 41 S. If you have recently moved to the City of St.

Search by Account Number or Address. You may be entitled to a personal property tax waiver if you were not required to pay personal property taxes in the previous years. E-File Your 2022 Personal Property Assessment.

How do I get a personal property tax waiver in St Louis County. You may file a Small Claims case in the St. You moved to Missouri from out-of-state.

All Personal Property Tax payments are due by December 31st of each year. If time is not an. Louis assessor if you did not own or possess personal property as of January 1.

Charles County on January 1 of the required tax year. Personal property tax waivers Personal property accountstax bill adjustment add or remove vehicle Pay taxes EXCEPT for delinquent real estate taxes 2017 and older. Louis collector if you did not own or have under your control any personal property as of January 1.

You moved to Missouri from out-of-state. You may be entitled to a personal property tax waiver if you were not required to pay personal property taxes in the previous years. Ask A Real Estate Agent.

8am 430pm Services Offered. Personal property tax waivers Personal property accountstax bill adjustment add or remove vehicle Pay taxes EXCEPT for delinquent real estate taxes 2017 and older. You may pay at our office located at 729 Maple Street Hillsboro MO 63050 online at Jefferson County Property Taxes or by Interactive Voice Response by calling 877-690-3729 if paying by IVR you will need to know your bill number.

41 South Central Avenue Clayton MO 63105. You will need to contact the collector in the county of your residence to request the statement of non-assessment and contact the assessor to have the property. Assessments are due March 1.

You may be entitled to a personal property tax waiver if you were not required to pay personal property taxes in the previous year s. Ad Reduce property taxes for yourself or others as a legitimate home business. 8am 430pm M F.

Louis MO 63129 Check cash money order Check cash money order M F. 8 Ways To Find The Owner Of A Property.

Temp Tags New Missouri Vehicle Sales Tax Law Takes Effect In August R Stlouis

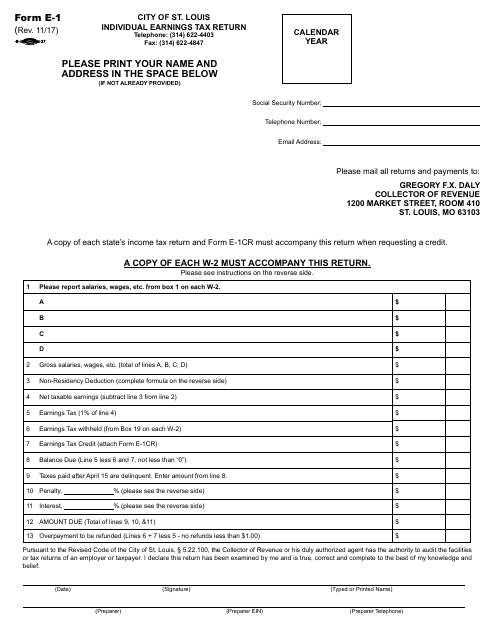

Form E 1 Download Fillable Pdf Or Fill Online Individual Earnings Tax Return City Of St Louis Missouri Templateroller

Lot Bill Olendorf 20th Century Four Signed Prints Celebrating St

Job Opportunities St Louis County Missouri Careers

A Midas Touch Home St Louis Missouri

Lot The St Louis Coffin Co Advertising Catalog Book

Form E 1 Download Fillable Pdf Or Fill Online Individual Earnings Tax Return City Of St Louis Missouri Templateroller

Lot The St Louis Coffin Co Advertising Catalog Book

Protesters Storm St Louis Police Headquarters

Permits And Applications Procedures St Louis County Website

Form E 1 Download Fillable Pdf Or Fill Online Individual Earnings Tax Return City Of St Louis Missouri Templateroller

Lot Daniel Fitzpatrick Missouri Wisconsin 1891 1969 St Louis County Government Mixed Media

A Place In Cook County The Property Owner S Resource Guide Pdf Surface Runoff Stormwater